EVERY NEW YEAR, most people make a resolution to stop eating junk food and to hit the gym to get their body in shape for bathing suit season. What most people forget to beef up is their financial fitness. That’s where Alexa von Tobel and her company LearnVest.com come in. LearnVest.com is a personal financial planning site that everyone can tailor to their own specific needs. Before graduating from Harvard (ahem!), von Tobel took a leap of faith and left to become the CEO & founder of the site. Now, in addition to LearnVest.com’s massive success, the New York Times bestselling-author cum recipient of too many honors to list cum radio show host has turned her financial expertise into an empire for the rest of the world’s benefit. von Tobel spoke with Lady Clever about her journey — from learning the basics of personal finance to becoming a mogul — and shared her best tips on how us non-money minded folk can plan for our financial futures.

What inspired you to start LearnVest.com?

When I was graduating from college and headed to a job on Wall Street, I realized I had never learned the basics of personal finance. I wanted to start out on the right foot with my money, but could not find a resource that spoke to me.

When the [r]ecession hit, I decided to take a risky move, and I dropped out of business school to launch LearnVest. I knew that at that moment — more than ever — people were in need of help to understand and make progress on their money.

In addition to being LearnVest’s CEO and founder, you’re also an author, columnist, and radio host. Did you ever think your career in finance would lead you to such a public platform?

I am humbled by all of the opportunities I’ve had to share LearnVest, and I love these parts of my job. There’s nothing like being on the road and talking to people face-to-face about their financial questions (or answering them on SiriusXM!). Money is an incredibly emotional topic, and I’ve been so inspired by these personal interactions.

I have always wanted to make financial planning accessible to people across the country, so if it means talking about money on these platforms the way I would talk to a friend, I’m thrilled to do it.

What would you consider one of LearnVest’s biggest successes?

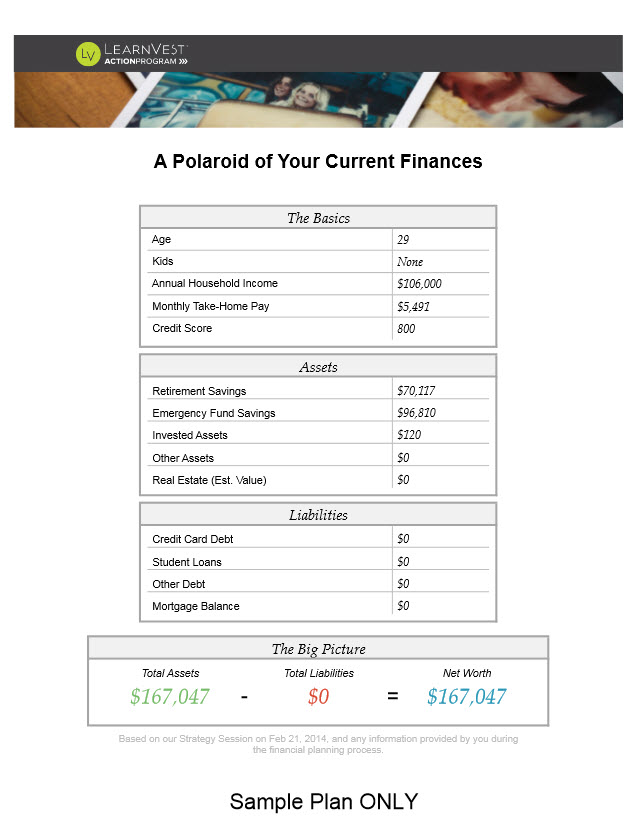

I consider our biggest success the development of a comprehensive and dynamic financial planning platform. We’re a technology company with a human core, and we’ve now refined our proprietary software (like TurboTax for financial planning) to be fully in line with our philosophy. The LearnVest Program is centered on behavior change — we help people get financial plans, but more importantly, we help them put those plans into action.

Do you think that women should keep their accounts and finances separate from their partner’s? Should you have an individual financial plan even when you’re in a relationship?

I believe everyone (regardless of gender) should have a clear financial plan. I always say, not having a plan is a plan, just a very bad one. A core part of a financial plan is making sure you’re protecting yourself and putting proper safety nets in place, from an emergency fund to insurance coverage. If you decide to manage your finances with someone else, I recommend being incredibly thoughtful about making sure you are personally protected. I don’t want you to be in a situation where you’ve cosigned on a credit card and are suddenly responsible for someone else’s debt. Or where you’ve failed to save for retirement in your own name.

I also recommend taking the time to have candid money talks with your partner. It can be a great way to get on the same page about your shared goals and how you can support each other in achieving them.

Do you think women should save or invest differently from men?

There are a lot of studies around women and men’s varying investing styles. At the end of the day, I think your investment needs are really unique to you — your budget, your goals, and your risk tolerance. Many people think that tackling their money boils down to learning how to invest better. But we believe there are a lot of things to consider before you have extra money to invest — like setting up an emergency fund and contributing as much as possible to your retirement.

If you could give women only one piece of financial advice you think is crucial for them to follow, what would it be?

If you could give women only one piece of financial advice you think is crucial for them to follow, what would it be?

Get a financial plan. I think having a plan is one of the best tools for reaching your goals, financial and otherwise. It also means that you’ve taken the time to deal with your money. By tackling it head-on, I believe we can transform money from being a leading cause of stress into a tool that helps us lead the lives we want.

Is there any advice you’d like to offer female entrepreneurs just starting out, either that’s been passed down to you or from your own experience?

One of my favorites is: when everyone zigs, zag. Starting a business is scary, but you can’t be afraid to take that risk and go for it.

LearnVest.com wants all of the clever ladies out there to be financially savvy. Use the promo code: LADYCLEVER until Jan 31st, 2015 to receive $50 off on LearnVest.com services.

Keep up with Alexa and LearnVest on Twitter, Facebook and Pinterest.

-300x200.jpeg)

-300x241.jpeg)